National Bureau Of Statistics: China Purchasing Managers Index (PMI) Was 49.0% In July

1、 Operation of purchasing manager index in China's manufacturing industry

In July, the purchasing manager index (PMI) of the manufacturing industry was 49.0%, 1.2 percentage points lower than that of the previous month, which was below the critical point, and the prosperity level of the manufacturing industry fell.

In terms of enterprise scale, the PMI of large and medium-sized enterprises were 49.8% and 48.5% respectively, down 0.4% and 2.8% compared with the previous month, falling below the critical point; The PMI of small enterprises was 47.9%, down 0.7% from last month, still below the critical point.

In terms of the sub index, the supplier delivery time index is higher than the critical point, while the production index, new order index, raw material inventory index and employee index are all lower than the critical point.

The production index was 49.8%, down 3.0 percentage points from the previous month, falling below the critical point, indicating a slowdown in manufacturing activity.

The index of new orders was 48.5%, down 1.9 percentage points from the previous month, falling below the critical point, indicating that the demand of the manufacturing market has fallen.

The inventory index of raw materials was 47.9%, down 0.2% from the previous month, indicating that the inventory of major raw materials in the manufacturing industry continued to decrease.

The employment index was 48.6%, down 0.1% from the previous month, indicating that the employment situation of manufacturing enterprises has declined slightly.

The supplier delivery time index was 50.1%, 1.2 percentage points lower than the previous month, still higher than the critical point, indicating that the delivery time of raw material suppliers in manufacturing industry was slightly faster than that of last month.

2、 China's non Manufacturing Purchasing Manager Index

In July, the non manufacturing business activity index was 53.8%, down 0.9% from the previous month, still in the expansion range, and the non manufacturing industry recovered growth for two consecutive months.

In terms of industries, the business activity index of the construction industry was 59.2%, up 2.6 percentage points over the previous month. The business activity index of the service industry was 52.8%, down 1.5 percentage points from the previous month. From the perspective of industry situation, the business activity index of railway transportation, air transportation, accommodation, catering, telecommunication, radio, television and satellite transmission services, ecological protection and public facilities management, culture and sports industry is in a relatively high boom range of more than 55.0%; The business activity index of capital market services, insurance, real estate, leasing and business services industries was lower than the critical point.

5% lower than that of the previous month, indicating that the non critical market demand decreased by 49.5% compared with the previous month. In terms of industries, the index of new orders in the construction industry was 51.1%, up 0.3 percentage points over the previous month; The index of new orders in the service sector was 49.5%, down 4.2 percentage points from the previous month.

The input price index was 48.6%, 4.0 percentage points lower than that of the previous month, falling below the critical point, indicating that the overall level of input prices used by non manufacturing enterprises for business activities decreased compared with that of the previous month. In terms of industries, the price index of construction inputs was 45.0%, down 3.7 percentage points from the previous month; The price index of service inputs was 49.2%, down 4.1 percentage points from the previous month.

The sales price index was 47.4%, 2.2 percentage points lower than that of the previous month, which continued to be below the critical point, indicating that the overall level of non manufacturing sales prices declined more. In terms of industries, the sales price index of the construction industry was 50.2%, down 0.1 percentage point from the previous month; The sales price index of the service industry was 46.9%, down 2.6 percentage points from the previous month.

The employment index was 46.7%, down 0.2% from the previous month, indicating that the employment situation of non manufacturing enterprises has declined. In terms of industries, the construction industry employee index was 47.7%, down 0.6 percentage points from the previous month; The service sector employment index was 46.6%, flat with the previous month.

The expected index of business activities was 59.1%, down 2.2 percentage points from the previous month and continued to be higher than the critical point, indicating that non manufacturing enterprises are generally optimistic about the recovery and development of the market in the near future. In terms of industries, the expected index of construction business activities was 61.0%, down 2.1 percentage points from the previous month; The expected service business activity index was 58.8%, down 2.2 percentage points from the previous month.

3、 Operation of China's comprehensive PMI output index

In July, the comprehensive PMI output index was 52.5%, 1.6 percentage points lower than the previous month, still higher than the critical point, indicating that the overall production and operation of Chinese enterprises continued to recover expansion.

- Related reading

National Bureau Of Statistics: Fixed Assets Investment In Textile Industry Increased By 11.9% In The First Half Of The Year

|

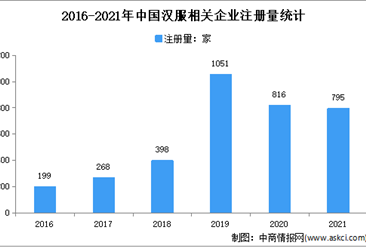

Analysis Of Hanfu Industry: The Future And Current Situation And The Data Of Consumption Behavior

|

Big Data Shows That Chinese Hanfu Enterprises Are Mainly Distributed In Guangdong

|- Shanghai | Shanghai Introduces 366 First Stores Of All Kinds, Leading The Country

- Women's wear | Attention: AI Media Consulting Released The Top 10 Chinese Women'S Underwear Brand List

- Listed company | GCL Energy Technology (002015): The Subsidiary Plans To Increase The Capital Of The Partnership By 400 Million Yuan

- Listed company | Changshan Beiming (000158): Received 37.9111 Million Yuan Of Government Subsidies Recently

- Listed company | Longtou Shares (600630): The Rent Of 187 Tenants Will Be Reduced By 43.37 Million Yuan

- quotations analysis | International And Domestic Market Environment Analysis Of Cotton Trend

- Market trend | Market Dynamics: The Cancellation Of American Cotton Contracts Increased, Traders Fell Into A Passive Position

- Industry perspective | Global Perspective: Analysis Of The Complex New Situation Of Global Clothing Retail In Recent Two Months

- market research | Trade Friction Industry Escort: Enterprises Actively Defend And Do A Good Job In Case Early Warning

- Children's wear shop | Hey Junior School Uniform Brand Participated In The Creation Of 2023 Shanghai Style Children'S Fashion Trend Released

- Shanghai Introduces 366 First Stores Of All Kinds, Leading The Country

- Attention: AI Media Consulting Released The Top 10 Chinese Women'S Underwear Brand List

- GCL Energy Technology (002015): The Subsidiary Plans To Increase The Capital Of The Partnership By 400 Million Yuan

- Changshan Beiming (000158): Received 37.9111 Million Yuan Of Government Subsidies Recently

- Longtou Shares (600630): The Rent Of 187 Tenants Will Be Reduced By 43.37 Million Yuan

- International And Domestic Market Environment Analysis Of Cotton Trend

- Market Dynamics: The Cancellation Of American Cotton Contracts Increased, Traders Fell Into A Passive Position

- Global Perspective: Analysis Of The Complex New Situation Of Global Clothing Retail In Recent Two Months

- Trade Friction Industry Escort: Enterprises Actively Defend And Do A Good Job In Case Early Warning

- Hey Junior School Uniform Brand Participated In The Creation Of 2023 Shanghai Style Children'S Fashion Trend Released